Today’s chart shows the year-over-year growth of global advertising expenditure in 2012, broken down by region.http://www.statista.com/markets/14/media-advertising/chart/1042/growth-of-global-ad-spend-in-2012/

Global advertising markets grew 3.2 percent in 2012, bringing the total ad spend to $557 billion.

Advertising expenditure grew in all regions except Europe, where the ongoing debt crisis forced companies to make deep cuts to their ad budgets.

Even Germany, one of the countries less affected by the crisis, reported declining ad expenditure for the second half of 2012.

Overall, European ad expenditure fell 4.2 percent in 2012, but it can be safely assumed that ad budgets in debt-ridden countries such as Greece, Italy and Spain saw much deeper cuts than that.

Ad spending in North America saw healthy growth in 2012. The largest ad market in the world grew 4.6 percent and strongly contributed to the global uptick in ad spending. Advertisers in the Middle East and Africa benefitted from the region’s improved economic and political situation. Egypt alone reported a 20 percent increase in ad spending a year after the 2011 revolution.

Today’s chart illustrates total funds raised through crowdfunding in different regions during 2012.

In the past few years, as financial markets went through tumultuous times, the internet brought forth a new way for individuals and companies to raise funds. Crowdfunding platforms such as Kickstarter allow creative minds to introduce their ideas to the public and to collect funds from many small contributors.

Crowdfunding passed a couple of significant milestones last year. In January 2012, the Elevation Dock, an iPhone dock made from solid aluminium, became the first Kickstarter project to raise more than $1 million. Four months later, Pebble, a watch that connects to smartphones through Bluetooth, became the first crowdfunded project to pass $10 million in funding. Both the Pebble and the Elevation Dock have started shipping by now, proving that crowdfunding has the potential to turn ideas into actual products.

In 2012, the total volume of funds raised through crowdfunding grew 81 percent to reach $2.7 billion. That’s according to data published by massolution, a research firm that specializes in crowd powered business. Massolution expects crowdfunding to accelerate even further this year. The company predicts the global total could reach $5.1 billion in 2013, which would be equivalent to a growth rate of 92 percent.

Thus far, crowdfunding is pretty much limited to North America and Europe. Both continents combined accounted for 96 percent of the global crowdfunding volume, with the remaining 4 percent raised in Asia and Oceania.

The World Wide Web continues to grow bigger and bigger. Today’s chart illustrates the growth of registered domain names since 2007.

By the end of 2012, more than 252m domains had been registered worldwide. That is a 12 percent increase over the end of 2011.

Interestingly, the growth of registered domain names is currently re-accelerating after a brief slowdown in 2009 and 2010.

The most common top-level domain remains .com with more than 100 million registered domains, followed by .de (Germany), .net and .uk (United Kingdom).

Today’s chart shows the market share of leading smartphone platforms in the United States from January 2011 through February 2013.http://www.statista.com/topics/876/android/chart/1028/smartphone-platform-market-share-in-the-us/

After a long period of sustained growth, Android’s market share in the U.S. smartphone market has recently taken a slight hit. According to recent comScore data, Android’s market share dropped to 51.7 percent in the three-month period ending February 2013. This marks the third consecutive decline of Android’s market share since hitting a peak of 53.7 percent in November 2012.

Google’s mobile operating system is still the number one smartphone platform by a relatively comfortable margin, but Apple’s iOS has regained some lost ground in the past few months. Android developers probably won’t be too worried by this short-term trend though. The imminent release of Samsung’s new flagship model, the Galaxy S4, will probably re-accelerate Android’s growth in the U.S. and elsewhere. Moreover, Apple’s momentum is likely to slow down in anticipation of the next iPhone refresh which isn’t expected until later this year.

As Sheth’s Rule of Three would predict, the number 1 and number 2 mass market competitor compete with each other in incremental fashion for market share. The number 3 position competitor on the mass market line will be the most likely to innovate sufficiently to leap frog one or both. This may also be an indication the smart phones as an industry are more mature than popularly believed. I would expect a new disrupter on the scene as this industry matures.

Show rooming describes the act of examining goods in a brick and carry store but making the actual purchase online (click and tarry). In the age of smartphones, tablets and ubiquitous price information, show rooming has become a real issue for traditional retailers.

Today’s infographic, created in cooperation with the American Association of Advertising Agencies, illustrates why and how consumers engage in showrooming. Understanding the motives behind showrooming is crucial for retailers who want to convert showroomers into buyers.

http://www.statista.com/topics/871/online-shopping/chart/1024/showrooming-infographic/

Show rooming has been assailed as a real threat to brick and carry businesses. Working from that belief alone is inadequate. Brick and Carry (and every single other business) faces threats everyday. The fittest are those who understand a threat and begin to respond.

Let’s begin with what are the advantages of ‘bricks and carry’ over ‘clicks and tarry’:

1. Location

2. Service

3. Human interaction

The brick and carry enable the shopper the obvious tactile advantage. But here is where brick and carry fail to take advantage of that advantage, store associates. The best trained and motivated associates know how to identify opportunities and assist the buyer. They also are able to explain the features and benefits, and the other products necessary to operate the product in the manner the purchaser desires. The stores with unengaged, untrained and unmotivated associates suffer in sales. You know the ones referred to here. They are the stores where you have to hunt for an associate who will look at you, isn’t running to their break and will take the time to be more than a “I’ll go see if we have it in the stock room” associate.

The brick and carry have the advantage for on site services; on the spot refunds, exchanges for other items, repair, set up, and possible classes and training. One opportunity not seen exercised is exclusivity. Meaning, if you didn’t purchase it from us or another click and carry, you will have to go back to your online service. Has anyone ever booked a hotel online, not through the hotel reservation system, for a bargain price? I have and will never do it again. I deserved a refund because I could not arrive on time. Their response, you’ll have to go back to the .com you booked the reservation. That turned out to be a sterling example of paying a little more for service.

Then there is the human interaction. This opportunity involves everyone from the door greeter to the stock room guy, up to the managers. Smiling and being polite, looking at a potential buyer when speaking and listening, and being anxious to assist. These are experiences one does not receive on line.

If price is the main motivation for the show roomer, then there is an absence in value in the brick and carry price. Brick and carry would be best advised to demonstrate the value by emphasizing the brick and carry experience and realize that servicing the price conscience may not be their target market. In summary, respond by using the advantages one has to compete and focus on the true target market.

Today’s chart illustrates how Facebook users in the United States are shifting their use of the service from PCs to smartphones, while overall engagement rises.http://www.statista.com/topics/751/facebook/chart/1026/mobile-facebook-use-in-the-us/

The fact that Facebook sees its future on mobile devices has been undisputed for a while now. Since yesterday, it is clearer than ever. ‘Home’, the new Android app introduced during yesterday’s presentation takes the deep Facebook integration known from iOS 6 and takes it two steps further on compatible Android smartphones.

Once installed, ‘Home’ lays itself atop the regular user interface and firmly positions Facebook interactions at the centre of the user experience. It has the potential to turn every Android phone into the ‘Facebook Phone’ that has been one of the more persistent rumours in the tech world for a while now. For Facebook this move appears to make sense: why go through the troubles of designing an entire operating system, let alone the hardware, if you can just slam all your ideas on top of an existing OS. No less than the number one smartphone operating system in the world by the way. The potential reach of Facebook Home is enormous.

Of course Facebook will start serving ads on Home’s new lock screen sooner or later, and of course Zuckerberg and his team will be smart enough to exploit the total access to soft- and hardware Android grants developers. For Facebook, yesterday’s event was a major step in the company’s push towards mobile. Now it’s up to its users to decide just how much Facebook they want on their smartphones.

Today’s chart shows a worldwide IT spending forecast. http://www.statista.com/markets/15/topic/124/it-services/chart/1022/it-spending-forecast/

Despite difficult economic circumstances global IT spending is expected to increase by 4.1 percent this year. Market research firm Gartner predicts total spending on IT services and hardware to reach $3.8 trillion this year, up from $3.6 trillion in 2012.

Telecom services account for the lion’s share of global IT spending. Growth in this category is expected to be rather flat, while spending gradually shifts from voice and fixed data services to mobile services.

Devices remain the fastest-growing segment in the IT industry, as sustained strong demand for smartphones and tablets is expected to overcompensate for stalling PC sales. In 2013, total spending on PCs, tablets, mobile phones and printers is expected to reach $718 billion, up 9 percent from 2012.

Today’s chart shows the digital share of recorded music sales in the world’s largest music markets.http://www.statista.com/markets/14/topic/111/music-audio/chart/1020/digital-music-adoption/

Over the past 10 years, digital music distribution has moved out of the niche and into the mainstream.

In 2012, digital music accounted for almost 60 percent of recorded music sales in the United States, making it the most advanced music market in the world.

Other major markets, such as the United Kingdom, see the same trend towards digital music distribution but are still a couple of years behind the U.S. market.

The growing adoption of smartphones played a decisive role in the rise of digital music services, as smartphones have made the whole process of purchasing, managing and consuming digital music much more convenient. Moreover, high-speed cellular networks have freed streaming services such as Spotify and Pandora from the shackles of a fixed-line internet connection, making them more attractive to today’s on-the-go consumer.

Of the trends in the chart, one begs the question “Why is Japan trending lower since 2009?”

http://www.statista.com/topics/779/mobile-internet/chart/1009/mobile-internet-traffic-growth/

Today’s chart illustrates how mobile internet traffic is growing even quicker than fixed-line internet traffic did back in the 1990s and early 2000s.

Between 1997 and 2003, global internet traffic grew at an average annual growth rate of 127%, from just 5 petabytes per month in 1997 to 681 petabytes per month in 2003. The internet was changing our lives in a way and at a pace that was at once unprecedented and seemingly unrepeatable.

Fifteen years later, we are in the middle of the “mobile revolution” which is happening even quicker than the first digital revolution did a decade ago.

Since 2006, mobile IP traffic exploded from 4 petabytes to 885 petabytes per month, which is equivalent to an average annual growth rate of 146%. In the past year, mobile traffic was already 12 times as high as total internet traffic was in 2000.

With growing adoption of smartphones, tablets and most importantly high speed networks such as LTE, mobile IP traffic is expected to continue growing rapidly through the next few years. By 2017, mobile traffic is expected to reach 11 exabytes per month, a more than 12-fold increase over last year’s level.

By the way, someone should tell Al Gore thanks for inventing the internet. http://www.youtube.com/watch?v=BnFJ8cHAlco

http://www.statista.com/topics/737/twitter/chart/1015/twitter-advertising-revenue-forecast/

According to a new forecast by eMarketer, Twitter’s ad revenue could more than double this year to reach $583 million.

This surge in ad dollars is largely powered by an increased interest in mobile advertising on Twitter. Mobile ad revenue is predicted to soar 123% this year and could account for more than half of Twitter’s total ad revenue.

The lion’s share of Twitter’s revenue is still generated in the United States. In 2012, only 10% of Twitter ad dollars were spent outside the United States. The company’s continued expansion of foreign sales operations is expected to bring this percentage up to 24% by 2015.

Today’s chart shows estimates for Twitter’s ad revenue from 2011 through 2015.

The Pew Research Center released its Annual Report on American Journalism. It is an ominous reading for the Fourth Estate. Americans Show Signs of Leaving a News Outlet, Citing Less Information | State of the Media.

In the report is evidence Americans are noticing the quality and quantity of news reporting is declining. Many of those who have noticed the decline have made the decision to abandon their news source.

Today’s chart shows a forecast of global smartphone, tablet and PC shipments from 2012 through 2017. http://www.statista.com/topics/840/smartphones/chart/1011/connected-device-shipment-forecast/

The rise of mobile devices continues. According to market research firm IDC, tablets will outship desktop computers for the first time this year and go one to overtake laptop computers in 2014.

Smartphones outshipped PCs for the second time last year. 722 million smartphone were shipped in 2012, bringing the worldwide installed base easily past the one billion mark.

In 2014, smartphone shipments are expected to pass one billion for the first time, marking another milestone in the remarkable rise of smart devices.

Today’s chart shows the world’s largest movie markets, based on 2012 box office revenue.http://www.statista.com/markets/14/topic/112/radio-tv-film/chart/1006/box-office-revenue-in-the-worlds-largest-movie-markets/

The North American movie market remains the largest market by a wide margin. In 2012, box office revenue in the United States and Canada amounted to $10.8 billion or 31% of the global total.

For the first time in 2012, China overtook Japan to become the world’s second largest film market. Chinese movie ticket sales amounted to $2.4 billion last year, a 36% increase over 2011 and enough to relegate Japan to third place.

Overall, global box office revenue increased 6.4% to reach $34.7 billion in 2012. International box office revenue grew 32% over the past five years, whereas the North American market grew only 12.5% since 2008.

http://www.statista.com/topics/1137/online-video/chart/1002/watched-videos-on-u.s.-video-sites/

A few days ago, comScore reported that 178 million U.S. unique visitors watched 33 billion online videos in February. Not surprisingly, Google/YouTube is the most popular video content property by far. People watched 1.2 billion videos on Google websites, equalling 34 percent of all videos seen in the United States. Much more interesting is that Facebook comes third behind AOL with 558 million video views. That’s a new all time high for the social network. Also worth mentioning is the fact that the U.S. online video audience is shrinking. In comparison with February 2012, the number of unique viewer fell short by one percent while the number of watched videos declined 13 percent.

http://www.statista.com/markets/14/media-advertising/chart/1000/audience-growth-of-u.s.-news-media/

In 2012, the audience of news websites increased by 7.2 percent, according to the State of the News Media 2013 Report. Even though digital news growth has been impressive, it has slowed down in comparison to 2011. Cable TV is the only other news channel that saw an audience increase last year, rising just 0.8 percent. This represents a very weak performance for “a presidential election year, which in the past has played to cable’s strengths”, a point noted in the report. The biggest news looser in 2012 is local TV with a 6.5 percent audience decrease, followed by network TV which fell 1.9 percent. Newspaper and magazine audiences made no gains on their 2011 levels.

Best regards

http://www.statista.com/topics/870/iphone/chart/998/iphone-versus-samsung-galaxy-sales/

48 million iPhones were sold in the fourth quarter of 2012 compared to 38 million Samsung Note, Note II, S II and S III devices. The figures for Samsung are based on an estimate by U.S. financial services firm Raymond James. So far, the South Korean company has managed to put its Cupertino competitor in the shade just once – in the third quarter of 2012. During that time period, the pace of iPhone sales slowed as customers waited for the new iPhone 5. Even though the distance between the two smartphone giants is considerable, it is becoming increasingly clear that Apple’s days of dominance have come to an end. Raymond James analyst Tavis McCourt even believes that Samsung will overtake Apple in the second quarter of 2013.

Just 18 percent of American households, namely those that earn more than $100,000 a year, hold 69 percent of the total consumer net worth.That’s according to Ipsos’ analysis of data from the 2010 Survey of Consumer Finances. Super affluents (those households with annual income above $250,000) hold a combined net worth of $25.3 trillion or 44 percent, even though they comprise less than 4 percent of American households.

Around 49 percent of all tablets shipped in 2013 will run Android, according to a recent forecast by IDC. This would rank Google’s operating system ahead of its major competitor, Apple’s iOS, for the very first time. In 2012, more than 50 percent of all tablets shipped were iPads. In the future, it appears that a stalemate will develop between Android and iOS. One reason for this may be that Microsoft, with Windows and Windows RT, will have a 10 percent share of the tablet market by 2017.

Today’s chart illustrates the unhealthy relationship between Pandora’s revenue growth and the growth of its royalty costs.http://www.statista.com/topics/1349/pandora/chart/972/pandora-s-revenue-vs-royalty-costs/

This was a busy week for Pandora. The company’s CEO Joe Kennedy surprisingly announced his resignation before reporting decent results for the fourth quarter of fiscal year 2013 (Pandora’s fiscal year ends January 31).

The popular internet radio continued to grow healthily in the past three months, but failed to turn a profit. Pandora has 65 million active users and total listening hours increased 52 percent over last year’s fourth quarter. The company now accounts for 77 percent of online radio listening and 8 percent of total radio listening in the United States. Revenue grew 54 percent to $125 million of which an impressive $80 million or 64 percent came from mobile usage.

The main problem with Pandora’s business remains the ever-growing cost of royalties and licensing fees. In the fourth quarter, content acquisition costs grew 59 percent, eating up more than 60 percent of the company’s revenue. After the Internet Radio Fairness Act (IRFA), which would have lowered licensing fees for internet radio services in the United States, didn’t get passed by the 112th United States Congress, Pandora recently reintroduced a 40-hour listening cap for mobile users with free accounts in order to limit escalating royalty costs.

It will be interesting to see if the new listening cap will help to limit costs without hurting revenue growth.

Today’s chart shows the 2012 market share of China’s top five smartphone vendors.http://www.statista.com/topics/840/smartphones/chart/975/market-share-of-top-five-smartphone-vendors-in-china/

Samsung claimed the top spot in the Chinese smartphone market for the first time in 2012, according to Strategy Analytics. The South Korean electronics giant sold 30.06 million smartphones in China last year, nearly tripling sales from 10.9 million units in 2011. Samsung’s market share of 17.7 percent was enough for the company to take the top spot in yet another market.

Chinese company Lenovo came in second with 13.2 percent market share, leaving Apple, which claimed 11 percent of the market, in third spot.

The top five are completed by two more Chinese brands, Huawei and Coolpad, with 9.9 and 9.7 percent market share, respectively.

Coolpad, owned by China Wireless Technologies, outsold Apple in the most recent quarter with low-cost smartphones that cost a fraction of Apple’s cheapest iPhone. With an average monthly wage below $600, the majority of Chinese consumers simply can’t afford to shell out $500 dollars or more on a mobile phone, which is why there have been persistent rumours of Apple planning a low-cost iPhone.

The 2011 market leader Nokia saw its market share collapse from 29.9 percent to 3.7 percent. The Finnish company fell out of the top five and is now the number seven smartphone vendor in China. In January, Nokia reported that revenue from mobile device sales in greater China had dropped 79 percent in the fourth quarter, a decline that can be attributed to the company’s decision to abandon Symbian in favour of Windows Phone. The fact that the average selling price of Nokia’s Windows Phone devices is much higher than it was for Symbian smartphones, has obviously hurt Nokia’s position in China.

Today’s infographic illustrates Google’s amazing growth since going public in 2004.http://www.statista.com/topics/1001/google/chart/977/googles-amazing-growth/

Since Apple’s fall from grace on the stock market, Google has emerged as the new Wall Street darling fromSilicon Valley.The company’s stock price is up 38 percent for the past 12 months, and closed at a new all-time high of $838.60 on March 5.

The reasons for Google’s latest rally are manifold. Most importantly, Google has a near-monopoly on web search and search advertising, yet manages to fend off antitrust allegations time and time again. The company’s mobile operating system Android has relegated Apple’s iOS to number two, putting Google in a great position as online activity is increasingly shifted towards mobile devices. On top of its operational success, Google has maintained its innovative edge, pursuing prestigious side-projects such as Google Glass or self-driving cars.

Today’s chart shows the revenues of Time Warner’s magazine publishing division from 2005 through 2012.http://www.statista.com/markets/14/topic/113/books-publishing/chart/966/revenue-of-time-warners-publishing-division/

After 574 years of service the printing press is looking at it’s imminent retirement. Yesterday afternoon, Time Warner surprisingly announced that it would spin off its magazine publishing division, Time Inc., into a separate public company.

Time Warner had previously been in talks to merge parts of the Time Inc. magazine portfolio with Meredith to form a new company, but the negotiations fell apart over some of Time’s most ‘prestigious’ titles – Time, Sports Illustrated, Fortune and Money – which Meredith didn’t want to include in the deal.

Time Warner’s magazine business hasn’t been spared by the industrywide declines and Time Inc.’s results have consistently lagged behind those of its parent company in recent years. From 2006 to 2012, revenue of Time Warner’s magazine division dropped 35 percent, while the company’s overall revenue grew 15 percent.

Time Inc. will be the latest in a row of prominent assets that Time Warner has freed itself of. In recent years, the company spun off AOL, Time Warner Cable and the Warner Music Group, in a bid to re-focus on its TV networks and filmed entertainment divisions. The spin off is scheduled to be completed by the end of the calendar year.

Who has the ability to knock down the walls of oligopoly which have benefited Mastercard, Visa, American Express and Discover? PayPal. They could become an industry disrupter. And the SME (small medium sized enterprises) may be a beneficiary.

PayPal unveiled new deals with a chain of fuel stations and a grocery store operator, as the payments division of eBay Inc tries to expand its service further into physical retail locations. PayPal said it signed payment deals with Mapco Express, a unit of Delek US Holdings which runs more than 440 retail fuel and convenience stores, and Spartan Stores, which distributes groceries to more than 400 locations, including 97 of its own stores.

That helped bring the number of PayPal physical, or brick-and-mortar, retail partners to 23, including Abercrombie & Fitch, Home Depot and J.C. Penney.

PayPal, a leading online payments network, is trying to expand into the physical retail world, a much larger market. Fuel stations and grocery stores are important partners for PayPal because consumers visit these types of retailers much more regularly.

PayPal is also working on agreements with drugstore chains, according to Don Kingsborough, the…

View original post 141 more words

Today’s chart shows a phablet shipment forecast, broken down by region. http://www.statista.com/topics/840/smartphones/chart/953/phablet-shipment-forecast/

When Samsung introduced the Galaxy Note in 2011, it was a bold move for the Korean electronics giant. With its 5.3-inch display, the smartphone was much bigger than Samsung’s flagship model, the 4.3-inch Galaxy SII, and the included stylus appeared like a relic from the pre-touchscreen era. Industry experts and tech journalists were largely sceptical whether the Note could find an audience. The device seemed too big to be used one-handedly, let alone to fit in a pants pocket.

Against all odds, the Galaxy Note became a success, selling more than 10 million units in its first year and spawning a new device category. The term phablet, a portmanteau of phone and tablet, refers to smartphones with 4.6 to 6.5-inch screens that are meant to combine the functionalities of smartphones and tablets.

According to ABI Research, more than 80 million phablets were shipped in 2012 and that number is expected to grow to 385 million by 2017.

Phablets are especially popular in the Asia-Pacific region. Last year, the region accounted for 42 percent of global shipments, a proportion that ABI expects to expand steadily over the next few years to reach more than 50 percent by 2017.

Today’s chart shows the stock price change of selected tech companies since January 2, 2013. http://www.statista.com/topics/951/linkedin/chart/949/stock-performance-of-tech-companies-in-2013/

Now that the first two months of 2013 have passed, it’s time to take a look at how some high-profile U.S. technology companies have performed in the stock market so far this year.

The clear winner thus far is LinkedIn. The social network for business professionals continued its run from 2012 and soared 45 percent since January 2. Backed by great results, analysts are very positive about LinkedIn’s business and investors apparently share their optimistic outlook.

The other obvious winner of 2013 is Google. The company continues to dominate the search market, delivers good results and creates positive press with innovative products such as Google Glass. Google’s stock price climbed more than 10 percent since January, bringing the company’s market cap to $264 billion.

On the other end of the spectrum is Apple, a company that used to be a Wall Street darling for the better part of the past ten years. Apple’s stock price dropped 10 percent since January and almost 40 percent since hitting its all-time high in September 2012. Even though the company is still remarkably profitable, it finds itself surrounded by negative sentiment and desperately needs a win to turn the momentum back in its favor.

The second loser of 2013 is Groupon. The company’s stock had just partly recovered from a terrible run in 2012, when disappointing fourth quarter results sent the stock sliding again. As a consequence, Groupon’s CEO Andrew Mason was fired, a decision that was received positively on Wall Street.

Today’s infographic provides an overview of Groupon’s latest financial results.http://www.statista.com/topics/824/groupon/chart/946/groupon-s-latest-financial-results/

Yesterday after market close, Groupon announced its results for the fourth quarter of 2012.

The company posted solid revenue growth but saw its international business decline.

Groupon reported revenue of $638 million, as gross billings soared to a record high of $1.52 billion.

The company posted a net loss of $81 million, disappointing investors who had hoped the company would be closer to profitability by now.

The outlook that CEO Andrew Mason gave, didn’t do much to calm the nerves of Groupon’s investors: for the current quarter, Mason gave a revenue guidance of $560 to $610 million. Analysts on average had expected $647 million.

Consequently, Groupon’s stock was punished in the after-hours market. The stock that had just climbed back from an all-time low, fell 25 percent in late trading on Wednesday. Before the late decline, the stock had closed at $5.98, 70 percent below the IPO price of $20.

This week, the mobile industry is gathering in Barcelona for the annual Mobile World Congress.

Device manufacturers, wireless carriers and app developers will come together with other industry insiders to discuss the current state of the mobile industry and to present what to expect in the near future.

Just in time for this event, IDC published a note last week that shows how well the mobile industry is currently doing.

In 2012, global Smartphone shipments grew 46 percent to 722 million units, i.e. smartphone shipments more than tripled since 2009, when 174 million units were shipped.

The tablet market too, did very well in the past year. Total shipments reached 128 million units, a 78 percent increase over 2011. The average selling price of tablets declined 15 percent to $461, mainly due to the success of lower-priced 7-inch tablets.

The PC industry continued to struggle in 2012. Shipments of laptop and desktop PCs declined 3 and 4 percent, respectively, as consumers are switching to mobile connected devices. Adding to the industry’s problems is the fact that update cycles are much longer for PCs than they are for smartphones. A new PC can probably serve an average user 5 years or longer, while smartphone vendors profit from 2-year update cycles and carrier subsidies. It is still too early to say if the tablet market can keep up the pace once it reaches a certain level of saturation, but it seems reasonable to assume that tablets carry a longer life cycle than smartphones typically do.

Today’s chart shows global shipments of smart connected devices in 2011 and 2012.

http://www.statista.com/topics/841/tablets/chart/934/global-shipments-of-smart-connected-devices/

.

On a recent flight home, there was a conversation behind me reminding me of a very important lesson I learned from my Grandmother one morning at breakfast.

Background regarding my Grandparents. Grandma grew up in south Texas, and was diligent in keeping a journal from the time she was a little girl. She received her teaching degree from the University of Texas and valued education. More importantly than that, she valued the use of the education one received. She met Grandpa, an heir to a sodbuster’s fortune in Kansas, an earthen hut. Grandpa received his degree in engineering from the University of Kansas. He paid for that education by pulling weeds, raking and any other odd jobs he could find during the Depression. When they met, Grandpa was smitten. He asked her to marry. She replied yes, and stated her plans were to travel and see the world. She recommended he be on board with that agenda. While working for Phillips 66, they lived around the world, visited every continent, and swam in every ocean and sea. They maintained a vast library of slide carousels of every trip. They shared the same passions; travel, culture, ornithology, classical music, education, the arts, dinner with friends and the art of conversation.

One year while visiting them in the summer, they celebrated their 50th anniversary. For an adolescent the golden anniversary seemed like an eternity. I asked Grandma while having breakfast alone with her how they were able to have such a long lasting and successful relationship. She set down her cereal spoon clumsily (she suffered from Parkinson’s disease), looked at me and said, “Most people will say a good partnership is 50/50. I say it’s 60/60.” I asked what do you mean? She replied, “Your Grandpa and I were each willing to go further than half way.”

Today, I enjoy the same quality of friendship, love and shared passion with my Bride. And when thinking of those words from Grandma, I realize we were committed to the same willingness. We will celebrate our Silver Anniversary this year.

How does this relate to a management consultant’s blog? I am often asked what is the key ingredient to successful business relationships. Sometimes it’s difficult to answer that without some sense of sadness, as my grandparents are no longer here. But the lessons I learned from them are.

Whether in personal or business matters, are you or are the other stakeholders willing to go 60/60?

Today’s chart compares Apple’s loss of market share since September 2012 with the current market cap of tech companies such as Google, Amazon and Facebook.http://www.statista.com/topics/847/apple/chart/928/apple-s-loss-of-market-share-since-september-2012/

Five months ago, on September 21, 2012, Apple’s iPhone 5 hit the stores in nine countries including the U.S., Japan,Germany and the U.K.

All was good in Cupertino. The company’s stock had just hit an all-time high, briefly pushing its market cap beyond $650 billion. Apple was the most valuable public company on earth by a wide margin.

What happened next is almost as remarkable as Apple’s meteoric rise over the preceding years: a couple of bad news mixed with the high expectations the company itself had created, were enough to turn the sentiment surrounding Apple completely around. Suddenly the company that had been Wall Street’s darling for years, struggled to deliver positive news and its stock price began to plummet. Over the past five months, the market shaved an incredible $235 billion off Apple’s valuation. To put things in perspective: $235 billion is roughly equivalent to twice Amazon’s market cap, four times Facebook’s valuation and 14 LinkedIns. It even comes close to the market capitalization of Google, one of Apple’s more potent competitors and current Wall Street darling.

2013 will be a crucial year for Apple, as Tim Cook and his team will try to refute the claims that the company’s best days are behind it.

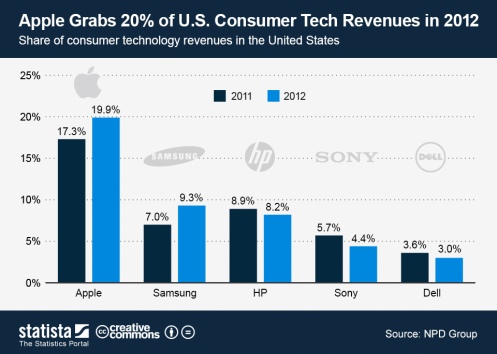

Today’s chart shows the share of consumer electronics sales accounted for by the Top 5 vendors in the United States.http://www.statista.com/topics/847/apple/chart/922/consumer-technology-revenues-in-the-united-states/

In the fourth quarter of 2012, Apple accounted for an astonishing 20 percent of consumer electronics sales in the United States. According to data published by the NPD Group, the top 5 consumer electronics categories in 2012 were notebook computers, flat-panel TVs, smartphones, tablets and desktop computers, with flat-panel TVs being the only category in which Apple does not hold a strong position. The long-rumoured Apple television set could change that and make Apple an even more dominant force in the consumer electronics industry.

Apple’s biggest rival Samsung was able to increase its share of total sales to 9.3 percent, overtaking HP to become the second largest consumer electronics vendor in the U.S.

Today’s chart shows the percentage of U.S. internet users who use social networking sites from February 2005 through December 2012.http://www.statista.com/topics/1164/social-networks/chart/913/the-rise-of-social-networking-in-the-united-states/

Last week, the Pew Research Center published a new report on the demographics of social media users in the United States, including data that nicely illustrates the rise of social networking across all age groups.

When social networking in the United States started to take off halfway through the past decade, it was primarily younger Americans who became hooked.

By August 2006, 49 percent of American internet users aged 18-29 were social network users, as opposed to 8 percent of those aged 30-49 and only 4 percent of those aged 50-64.

Since then, social networking quickly gained popularity and became a true mass phenomenon.

By the end of 2012, adoption among 30-49 year olds had almost caught up with 18-29 year olds, and almost a third of Americans aged 65 and older were social network users.

After an initial outcry by many who were shocked to find their parents on Facebook, it is now common for American families to stay in touch using a social network.

Today’s chart shows the share of retail e-commerce dollars spent via mobile devices in the United States.http://www.statista.com/topics/1185/mobile-commerce/chart/909/percentage-of-retail-e-commerce-dollars-spent-via-mobile-devices/

As tablet and smartphone adoption continues to grow, mobile commerce is becoming increasingly relevant to online retailers.

The percentage of e-commerce sales via mobile devices grew from 2 percent in the second quarter of 2010 to 11 percent in the fourth quarter of 2012. This increase was mainly caused by the rise of tablets in general and Apple’s iPad in particular. While smartphones are often used to research prices while shopping in brick-and-mortar stores (“showrooming”), people have long been hesitant to make purchases on the relatively small screen. Tablets have erased that problem, offering enough screen real-estate to comfortably go through the entire purchasing process. The conversion rate on tablets is three time as high as it is on smartphones. The rise of smartphones with 4.7+ inch screens, often called “phablets”, will likely further increase the mobile share of total e-commerce sales, as they combine the ubiquity of a phone with the screen-size, hence the comfort of a tablet.

Online retailers can no longer afford to ignore their mobile audiences and should recognize the growing importance of an attractive mobile presence.

Today’s chart shows smartphone operating system market share in Q4 2012, based on unit sales to end users.http://www.statista.com/topics/840/smartphones/chart/904/smartphone-os-market-share-in-q4-2012/

The race for the leading smartphone platform has been decided. In the fourth quarter of 2012, Android phones accounted for almost 70 percent of global smartphone sales to end users, relegating Apple’s iOS to a distant second. Apple still holds roughly one fifth of the smartphone market, but it won’t catch up with Android anytime soon. The third ranked BackBerry continued to lose market share, but will surely hope to regain some traction following the release of the well-received BlackBerry 10 OS. Microsoft increased its market share from 1.8 percent in Q4 2011 to 3 percent, but for now Windows Phone remains a niche platform.

Using the Sheth Rule of Three, we would expect Android and iOS to maintain the top 2 spots. Periodically they will leapfrog one another in an occasional bold move. In terms of product innovation, expect incremental gains as these two players dominate the market and innovation is not needed to maintain their profitable mass market positions. Blackberry risks falling into the ditch. An M&A opportunity may be their only hope. If breakthrough innovation comes from any of the players it will likely come from Blackberry as they have no choice but to innovate if they are to remain relevant. The other smaller players will likely consolidate and maintain their niche positions.

Today’s chart shows the year-over-year growth of Apple’s 9.7-inch iPad sales as estimated by Citi analysts based on IDC data.http://www.statista.com/topics/877/ipad/chart/903/year-over-year-growth-of-apple-s-ipad-sales/

The growing popularity of 7-inch tablets, including the iPad mini, is apparently hurting sales of Apple’s full-sized iPad.

According to a research note published yesterday by Citi’s Apple analyst, the Cupertino-based company is experiencing a dramatic slowdown of its 9.7-inch iPad business.

In the fourth quarter 2012, 9.7-inch iPad sales were almost flat, increasing only 1.8 percent year-over-year.

In the United States and Japan, sales of Apple’s flagship tablets even declined by 9 and 26 percent, respectively.

This surprisingly quick slowdown probably has two reasons:

For one, developed markets such as the U.S. and Japan might slowly approach saturation. Considering the fact, that the iPad, unlike the iPhone, can’t be updated upon renewal of a wireless contract every two years, a certain level of slowdown seems inevitable.

What’s probably more important though, is the fact that smaller (and cheaper) tablets are starting to take a considerable chunk of the tablet market. Google’s Nexus 7, Amazon’s Kindle Fire and Apple’s iPad mini are all seeing decent sales, as they offer a good-enough tablet experience at an affordable price.

In line with Steve Jobs’ thinking that “If you don’t cannibalize yourself, someone else will”, it’s probably been a smart move by Apple to introduce a smaller iPad nonetheless. Even though the iPad mini may eat into sales of the larger iPad and hurt Apple’s margins, it will help to keep customers within the iOS ecosystem rather than losing them altogether.

Today’s first chart shows the number of searches handled by leading search sites in December 2012.http://www.statista.com/topics/1001/google/chart/898/number-of-searches-handled-by-search-engines-worldwide/

In December 2012, more than 175 billion online searches were conducted worldwide. That is 65,000 searches per second, of which 65 percent were handled by market leader Google.

According to recent comScore data, the U.S. search giant handled an overwhelming 115 billion searches in December, distancing its strongest competitor Baidu by more than 100 billion searches.

8.2 percent of global searches were conducted on Baidu in December thanks to the company’s strong position in China. Yahoo surprisingly claimed the third rank, with 4.9 percent of all searches conducted on Yahoo’s sites. It should be noted that Yahoo’s search is powered by Microsoft’s Bing search engine, but comScore tracks the site on which a search is conducted rather than the underlying search engine.

With 2.8 percent of searches, Microsoft lost the fourth place in the ranking to Russian competitor Yandex, who handled 2.8 percent of all searches.

Our second chart shows the number of unique individuals using the top 5 search sites in December 2012.

When it comes to the number of searchers, Google’s market dominance is just as impressive.

In December, 77 percent of the 1.52 billion search engine users worldwide conducted a Google search at least once. That’s 1.17 billion Google users, as opposed to 293 million users of Baidu and 292 million users of Yahoo’s search. Microsoft’s Bing was used by 267 million people in December, clearly distancing Yandex in terms of reach.

Today’s chart shows AOL’s year-over-year revenue growth since 2008, nicely illustrating the slow progress the company has made in the past 2 years.:http://www.statista.com/markets/21/topic/195/search-seo/chart/891/revenue-growth-of-aol/

Former internet heavyweight AOL announced its first positive quarterly revenue growth in 8 years on Friday. Fourth quarter sales rose 3.9 percent to $599.5 million spurred by a 12.9 percent increase of advertising revenues. AOL’s stock price jumped more than 7 percent on Friday, as the company continues its climb back to relevance. AOL’s stock has surged 115 percent over the past 12 months, making it one of the hottest tech stocks of the past year.

The latest results mark a milestone in CEO Tim Armstrong’s quest to transform his company from a dial-up internet service provider into a digital media company. Since AOL’s spin-off from Time Warner in 2009, the company had acquired TechCrunch and The Huffington Post to re-position itself as an ad-selling provider of premium online content.

Today’s chart shows the net income of America’s most profitable companies in the quarter ended December 31, 2012.http://www.statista.com/topics/847/apple/chart/882/net-income-of-americas-most-profitable-companies/

When Apple released its results for the December quarter on January 23, the initial reaction of analysts, industry pundits and investors was overwhelmingly negative. The fact that the company had narrowly missed some of the goals set by Wall Street analysts, was widely considered final proof that Apple’s best days are behind it and, to quote one of the more extreme conclusions, that Apple is doomed. As a consequence, Apple’s stock plummeted, shaving tens of billions off the company’s market cap.

What most of the stories on Apple’s demise overlooked, or chose to ignore, was the fact that the company had just delivered record revenue and one of the highest quarterly profits ever to be reported by any company – ever. CEO Tim Cook later pointed out to Apple’s employees, that he felt his company was unjustly assessed by Wall Street and that “the only companies that report better quarters pump oil”.

Historically, Tim Cook was right on that point: the only companies that ever reported a quarterly profit higher than Apple’s $13.1 billion are ExxonMobil and the Russian energy giant Gazprom, who reported net profit of $16.2 billion in the first quarter of 2011.

Looking at the short term though, even oil companies fail to deliver better quarters than Apple. In the December quarter, Apple earned $3 billion more than ExxonMobil and at least $5 billion more than any other company in theUnited States. That includes oil companies such as Chevron, pharmaceutical companies such as Pfizer and financial institutions such as JPMorgan Chase.

So even though Apple is starting to show signs of an inevitable slowdown, the company remains incredibly profitable and, to borrow from the great Mark Twain, the reports of Apple’s death are greatly exaggerated.

Today’s chart shows the number of online buyers in selected countries in 2012.http://www.statista.com/topics/1007/e-commerce-in-china/chart/878/number-of-online-buyers-in-selected-countries/

As China’s online population continues to grow, the number of Chinese online shoppers also soars: a recent estimate by eMarketer puts the number of Chinese online buyers at 219.8 million in 2012, a 23 percent increase over 2011. The United States had 150 million online buyers in 2012, but remains the largest e-commerce market in terms of total sales. China is expected to become the second largest e-commerce market in the world this year, taking an estimated share of 14 percent of total sales and surpassing the UK and Japan.

If only we can access these online buyers and offer to sell something of value, maybe then we can reverse the trade imbalance!

Today’s chart illustrates consumer awareness and usage of digital wallet services in the United States.http://www.statista.com/topics/982/mobile-payments/chart/873/consumer-awareness-and-usage-of-digital-wallet-services/

The “digital wallet” refers to services that let you store payment information (i.e. credit or debit card) on your PC, smartphone or tablet to let you make online or offline purchases without having to re-enter that information or without using your actual wallet.

As much as we read about digital wallets being the future of payments, very few people actually seem to be using such services.

A new study by comScore reveals why digital wallet offerings are struggling to reach broad adoption: many people have never heard of them.

According to the study, only 51 percent of the responding consumers have ever heard of a digital payment service other than PayPal, and, to make things worse, only 12 percent of consumers have ever used one. eBay’s payment service PayPal is currently miles ahead of the competition in terms of consumer awareness and usage and it seems unlikely that any of the competing services can close that gap anytime soon. Starting off as a service to facilitate payments on eBay’s auction platform, PayPal has reached wide adoption among e-retailers and is currently pushing into physical retail as well.

Today’s chart shows top 10 apps for Android and iOS devices in the United States, based on unique users in December 2012.http://www.statista.com/topics/1002/mobile-app-usage/chart/869/top-10-android-and-ios-apps/

Facebook, a company frequently slammed for its mobile strategy in the past, finished 2012 as the number 1 app for Android and iOS devices in the United States.

In December, 85.6 million Americans aged 18 and older used Facebook’s mobile app on either Android or iOS devices. Facebook overtook Google Maps as the most-used app in October, after Apple had decided to dump Google’s mapping app from iOS 6. Google remains a dominant force in the app space though, as 5 of the top 6 apps are Google apps.

To Facebook, the success of its mobile app is crucial. Mobile advertising accounted for 23 percent of the company’s ad revenues in the past quarter and is considered the main driver behind Facebook’s future revenue growth.

Today’s chart illustrates two possible reasons behind the recent drop of Apple’s stock price: decelerating revenue growth and declining gross margins.http://www.statista.com/topics/847/apple/chart/864/two-reasons-why-apple-s-stock-is-sliding/

When Apple’s stock briefly traded above $700 in September, some bullish analysts raised their target for the stock to $1,000.

Four months and two disappointing earnings releases later, the tide has turned. Apple’s stock price dropped 35 percent since September, shaving $250 billion off the company’s market cap.

Apple’s growth in the past decade, particularly since introducing the iPhone in 2007, has been nothing short of breathtaking. Apple went from an also-ran computer vendor to a company generating profits in dimensions normally reserved to oil companies, as Tim Cook recently put it.

However, every great run inevitably comes to an end, and, as it seems, so did Apple’s. So what led to the turn in fortunes for Apple?

First of all, Apple created a monster of expectations that is getting increasingly hard to satisfy. A good quarter from Apple is no longer enough, as people are expecting great quarters. A great product is no longer enough, as people are expecting revolutionary products. The company finds itself under brutal scrutiny and every misstep, trivial or severe, turns into a major news story. As a consequence, Apple is having trouble producing good news, at a time when it desperately needs them to turn the momentum back in its favor

What’s more important though, is the fact that Apple’s growth machine appears to be cooling down a little bit. In recent quarters, revenue growth decelerated significantly as Mac sales slump and competition in the smartphone and tablet markets is heating up. Perhaps even more worrying is the fact that Apple’s gross margins have declined for four quarters in a row on a sequential basis. Many analysts are taking this as a sign that Apple’s profits may have peaked and that the company’s best days are behind it. If Apple’s margins continue to decline, the company will need to reaccelerate revenue growth in order to keep profits where they are now, let alone increase them.

The often rumoured Apple TV could certainly add a couple of billion to Apple’s revenues, but, as the TV market is a low margin business, it could also increase the pressure on Apple’s margins.

Today’s infographic sums up everything you need to know from Facebook’s earnings report.http://www.statista.com/topics/751/facebook/chart/859/facebook-s-fourth-quarter-earnings/

Facebook ended its first year as a public company with a solid holiday quarter. The company beat analyst expectations as it posted record revenue and returned to profitability.

Facebook’s fourth quarter revenue grew 40 percent to $1.59 billion. Mobile advertising accounted for 23 percent of ad revenues, up from 14 percent in the third quarter. A year ago, Facebook didn’t even serve ads to mobile devices; now these ads account for almost one fifth of the company’s total revenue. The decision to build a mobile ad business is the main driver behind the reacceleration of Facebook’s revenue growth. The company’s rate of revenue growth had declined for six straight quarters before the introduction of mobile ads in 2012.

In the fourth quarter, Facebook returned to profitability, posting a modest profit of $64 million.

However, CEO Mark Zuckerberg noted that short term profit growth is not a primary objective, as his company will continue to invest in future products to pursue long-term growth.

After a tumultuous year, Facebook’s shares ended 2012 on a positive note. By the end of the year, the stock was trading 50 percent above the all-time low it had hit in September.

The stock continued to climb through January and is slowly approaching the IPO price of $38.

Today’s chart illustrates Amazon’s quarterly results since 2008. http://www.statista.com/topics/846/amazon/chart/855/amazons-quarterly-results-since-2008/

Yesterday, Amazon reported fourth quarter earnings and revenue that were below Wall Street’s expectations. The e-commerce giant posted record sales of $21.3 billion, missing analyst expectations by $1 billion.

At $97 million, net income came in short of expectations as well, as Amazon’s focus on long-term growth continues to hurt its short-term results. The company is heavily investing in its digital services and sells its Kindle devices at cost to get customers locked into Amazon’s digital content ecosystem.

Amazon’s gross margin increased to 24 percent in the fourth quarter, a fact that was very well-received by analysts and shareholders, as higher margins suggest that Amazon’s current growth strategy will likely pay off in the future. As a result, Amazon’s stock price soared to an all-time high after the earnings release, despite missing targets on revenue and profit.

Today’s chart shows global smartphone shipments of the top 5 vendors in the fourth quarter of 2012.http://www.statista.com/topics/840/smartphones/chart/852/global-smartphone-shipments-in-q4-2012/

Samsung capped an impressive year 2012 with record smartphone sales in the fourth quarter. The Korean company shipped 63.7 million smartphones during the holiday quarter, outselling its biggest rival Apple by more than 15 million units.

Samsung’s strong line-up of high-end and low-cost smartphones has helped the company to increase shipments by 76 percent over last year’s fourth quarter.

Apple sold 47.8 million smartphones, cementing its status as the second largest vendor. With an increase of 29 percent, the Cupertino-based company saw the lowest relative growth among the top 5 vendors though, a testament to the stronger competition from company’s such as Sony, Huawei and ZTE. The latter two, both Chinese manufacturers, entered the top 5 as the Chinese smartphone market continued to grow rapidly.

Overall, smartphone demand remains strong as overall shipments in the fourth quarter rose 36 percent to a total of 219 million units.

Today’s chart shows the number of Google user data requests filed by the U.S. government.http://www.statista.com/topics/1001/google/chart/849/google-user-data-requests-filed-by-the-u.s.-government/

Google published its latest Transparency Report last week, revealing another increase in user data requests from governments around the world.

U.S. authorities were particularly hungry for Google’s user data, with 39 percent of global requests coming from entities of the U.S. government.

The number of user data requests filed by U.S. authorities has steeply increased over the past three years: In the second half of 2012, Google received more than twice as many requests from U.S. entities as three years ago, when Google started sharing this information with the public.

http://www.statista.com/topics/823/microsoft/chart/846/microsofts-2nd-quarter-results/

There were little surprises when Microsoft reported its second quarter results on Thursday.

The results were pretty much in line with analyst expectations as the company posted record sales along with a slight decline of profits.

Microsoft’s revenue increased 3 percent to $21.5 billion thanks to a strong showing of Microsoft’s Windows Division, which saw a 24 percent increase in sales over last year’s December quarter.

Profits declined 4 percent, marking the fifth straight quarter of declining profits for Microsoft.

Having released the radically redesigned Windows 8 operating system in October along with an own line of tablet computers, this year is going to be very important for Microsoft, as the company tries to make its mark in the mobile computing market.

http://www.statista.com/topics/847/apple/chart/843/apples-q1-2013-earnings/

Yesterday after market close, Apple published its results for the December quarter (Apple’s Q1 2013).

The Cupertino-based company posted record iPhone and iPad sales (48m and 23m units), better-than-ever revenue ($54.5b) and a sizeable $12 billion profit. Great news for Apple’s shareholders, right?

Not exactly. Despite the results being indisputably good, they were not great. And so, as analysts and investors are expecting nothing less than great from Apple, the company missed expectations on several points.

More importantly though, the results did little to silence those who say that Apple has peaked, and that its potential for future growth is waning.

Both revenue and profit growth have decelerated significantly as Apple narrowly avoided the first year-over-year decline of its quarterly profits. Apple is struggling to maintain its extraordinary margins, as the competition in the booming smartphone and tablet markets is increasingly fierce.

Apple’s stock price lost 10 percent in Wednesday’s after-hours trading, shaving $50 billion off the company’s market cap.

The company that used to be one of Wall Street’s darlings in the past few years will probably need another revolutionary device (such as an Apple TV) to bring its stock back into an upward trajectory.